Support - S1 : 0.6702 | S2 : 0.6652 | S3 : 0.6571

Resistance - R1 : 0.6833 | R2 : 0.6914 | R3 : 0.6963

Main Trend - Bullish

Intraday Trend - Bullish

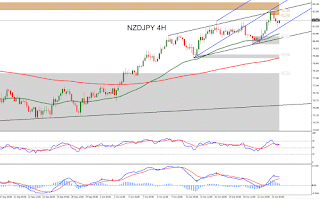

On forex technical analysis, at 4H chart is very clear the upward cross between EMA(50) and EMA(200). Price find support from EMA(50) and from the median line of Andrew's Pitchfork. We can observe that the price moves within a triangular formation.

Considering all the details from the charts of forex technical analysis we can detect all critical levels and trading targets for H1 and H4 timeframes:

The area 0.6770 – 0.6798 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 0.6864, 0.6895, 0.6930, 0.6967, 0.7025, 0.7086.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 0.6700, 0.6635, 0.6600, 0.6550, 0.6520, 0.6450.

The area 0.6755 – 0.6765 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 0.6785, 0.6800, 0.6830, 0.6850, 0.6865, 0.6910.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 0.6725, 0.6710, 0.6695, 0.6680.

There is no Harmonic Pattern on forex technical analysis for NZDUSD.

Using the above elements of forex technical analysis, everyone can plan his own personal forex trading strategy. We note the need to use stop-loss levels.

You agree with our estimates? If you have another point of view, you can write your opinion in comments.

You can subscribe to one of the two subscription packages and take advantage of all benefits of the forex signals using one of the most sophisticated Forex Signals Copier, also from monitoring the live trading room, and of course from the full support in real time.

Resistance - R1 : 0.6833 | R2 : 0.6914 | R3 : 0.6963

Main Trend - Bullish

Intraday Trend - Bullish

On forex technical analysis, at 4H chart is very clear the upward cross between EMA(50) and EMA(200). Price find support from EMA(50) and from the median line of Andrew's Pitchfork. We can observe that the price moves within a triangular formation.

Considering all the details from the charts of forex technical analysis we can detect all critical levels and trading targets for H1 and H4 timeframes:

4H Chart

The area 0.6770 – 0.6798 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 0.6864, 0.6895, 0.6930, 0.6967, 0.7025, 0.7086.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 0.6700, 0.6635, 0.6600, 0.6550, 0.6520, 0.6450.

1H Chart

The area 0.6755 – 0.6765 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 0.6785, 0.6800, 0.6830, 0.6850, 0.6865, 0.6910.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 0.6725, 0.6710, 0.6695, 0.6680.

There is no Harmonic Pattern on forex technical analysis for NZDUSD.

Using the above elements of forex technical analysis, everyone can plan his own personal forex trading strategy. We note the need to use stop-loss levels.

You agree with our estimates? If you have another point of view, you can write your opinion in comments.

You can subscribe to one of the two subscription packages and take advantage of all benefits of the forex signals using one of the most sophisticated Forex Signals Copier, also from monitoring the live trading room, and of course from the full support in real time.

No comments:

Post a Comment