Support - S1 : 1.1133 | S2 : 1.1057 | S3 : 1.0965

Resistance - R1 : 1.1302 | R2 : 1.1394 | R3 : 1.1470

Main Trend - Bullish

Intraday Trend - Bullish

Financial Announcements: USD - ISM Non-Manufacturing PMI

Considering all the details from the charts of forex technical analysis we can detect all critical levels and trading targets for H1 and H4 timeframes:

Price action at this critical level will show whether the price will have the strength to continue upward to a higher level.

The area 1.1190 – 1.1226 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 1.1270, 1.1295, 1.1340, 1.1365, 1.1400.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 1.1155, 1.1135, 1.1100, 1.1065, 1.1020.

The area 1.1217 – 1.1240 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 1.1275, 1.1295, 1.1315, 1.1350, 1.1380.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 1.1175, 1.1150, 1.1130, 1.1085.

Using the above elements of forex technical analysis, everyone can plan his own personal forex trading strategy. We note the need to use stop-loss levels.

You agree with our estimates? If you have another point of view, you can write your opinion in comments.

You can subscribe to one of the two subscription packages and take advantage of all benefits of the forex signals using one of the most sophisticated Forex Signals Copier, also from monitoring the live trading room, and of course from the full support in real time.

Resistance - R1 : 1.1302 | R2 : 1.1394 | R3 : 1.1470

Main Trend - Bullish

Intraday Trend - Bullish

Financial Announcements: USD - ISM Non-Manufacturing PMI

Considering all the details from the charts of forex technical analysis we can detect all critical levels and trading targets for H1 and H4 timeframes:

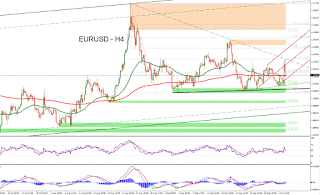

The price moves within the triangular formation and is located in the lower channel of an upward Andrews Pitchfork.

EMA (50) and the EMA (200) is flat and coincident to the same level.

After the upward movement above the EMA on Friday, the price continues with a pullback in order to do a retest to EMA (50) and EMA (200).

Price action at this critical level will show whether the price will have the strength to continue upward to a higher level.

4H Chart

The area 1.1190 – 1.1226 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 1.1270, 1.1295, 1.1340, 1.1365, 1.1400.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 1.1155, 1.1135, 1.1100, 1.1065, 1.1020.

1H Chart

The area 1.1217 – 1.1240 is a neutral zone.

Bullish scenario: If price moves upwards and close above the neutral zone, then the upward trading targets will be: 1.1275, 1.1295, 1.1315, 1.1350, 1.1380.

Bearish scenario: If price moves downwards and close below the neutral zone, then the downward trading targets will be: 1.1175, 1.1150, 1.1130, 1.1085.

Using the above elements of forex technical analysis, everyone can plan his own personal forex trading strategy. We note the need to use stop-loss levels.

You agree with our estimates? If you have another point of view, you can write your opinion in comments.

You can subscribe to one of the two subscription packages and take advantage of all benefits of the forex signals using one of the most sophisticated Forex Signals Copier, also from monitoring the live trading room, and of course from the full support in real time.

No comments:

Post a Comment